Accessing market data quickly and accurately is crucial for financial decision-making. Web scraping, powered by AI, simplifies this process by automating data collection from websites and converting it into structured formats like JSON.

Here’s why it’s valuable and how to get started:

-

Why Web Scraping Matters:

- Real-time data helps with stock trading, economic analysis, and pricing strategies.

- AI tools adjust to website changes, bypass anti-bot systems, and ensure uninterrupted data flow.

-

Key Features of Effective Tools:

- Block-proof scraping, CAPTCHA bypass, and JavaScript rendering.

- Geotargeting with global IPs for worldwide market access.

-

How to Start:

- Choose reliable data sources like stock exchanges, financial news sites, and government databases.

- Use tools like InstantAPI.ai for automated scraping, JSON formatting, and easy integration.

-

Ethical and Legal Compliance:

- Follow website terms of service, avoid overloading servers, and respect data ownership.

With the right tools and practices, web scraping can transform financial workflows, enabling real-time trading, sentiment analysis, and smarter investment decisions.

How to scrape STOCKS and FINANCIALS from YAHOO ...

Selecting Financial Web Scraping Tools

Picking the right tool can mean the difference between getting reliable, up-to-date data or dealing with inconsistent and delayed information. Modern AI-powered tools are simplifying financial data collection like never before.

Key Features for Financial Data Scraping

When it comes to scraping financial data, certain technical features are non-negotiable. These capabilities ensure that data collection is both accurate and dependable:

| Feature | Importance |

|---|---|

| Block-Proof Scraping | Ensures uninterrupted data gathering by bypassing anti-bot defenses |

| AI Automation | Keeps data accurate by adjusting to website changes automatically |

| JavaScript Rendering | Handles dynamic content from modern trading platforms |

| Worldwide Geotargeting | Provides access to global market data using over 65 million rotating IPs |

| CAPTCHA Bypass | Automatically solves CAPTCHAs to maintain smooth data flow |

These features are crucial for tools designed to handle the fast-paced demands of financial data scraping. AI-driven automation is especially critical for managing frequent website updates and delivering consistent results from multiple sources.

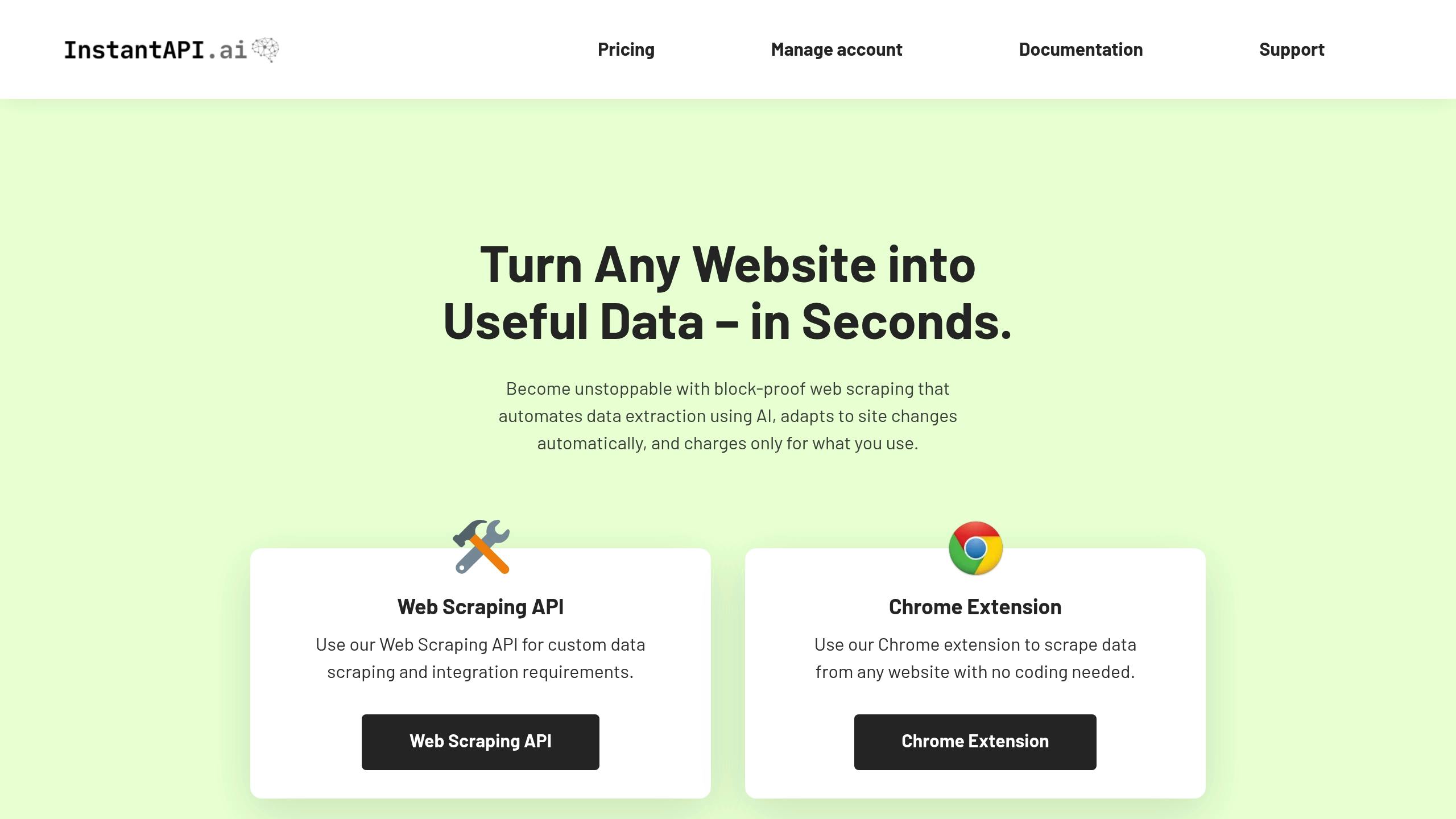

Getting Started with InstantAPI.ai

InstantAPI.ai takes these must-have features and simplifies financial data scraping with its AI-powered platform. With a success rate exceeding 99.99%, it offers both API access and a Chrome extension to cater to different user needs.

Here’s what sets InstantAPI.ai apart for financial data collection:

-

Real-Time Data Transformation

The AI engine instantly converts scraped data into custom JSON formats, making it ready for immediate use in financial models or analysis tools. -

Flexible Integration Options

Whether you need a no-code solution with the Chrome extension or advanced API access for tailored implementations, InstantAPI.ai adapts to your specific needs. -

Scalable Pricing

Its pay-as-you-go model, starting at just $5 per 1,000 pages, allows organizations to scale data collection without long-term financial commitments.

For enterprises, the platform also provides dedicated support, making it a reliable choice for financial market analysis and real-time trading strategies.

How to Scrape Financial Market Data

Finding Quality Data Sources

To gather reliable financial market data, start by choosing trustworthy sources. Assess each source for its data quality, how often it's updated, and how accessible it is. Stick to well-known and reputable options.

Here are some common types of financial data sources:

| Source Type | Data Points | Update Frequency |

|---|---|---|

| Stock Exchanges | Price, volume, market cap | Real-time/15-min delay |

| Financial News | Market analysis, earnings | Continuous |

| Economic Indicators | GDP, inflation, employment | Monthly/Quarterly |

| SEC Filings | Financial statements, disclosures | Quarterly/Annual |

"Selecting a reliable, up-to-date data provider is crucial for staying ahead in today's fast-moving financial markets." - Data Journal

Once you’ve identified your sources, you can set up your scraper to ensure it collects data efficiently and accurately.

Setting Up Your Scraper

Use InstantAPI.ai to configure your scraper for automated data extraction. Define the specific metrics you want to track, set how often the scraper should run, and include error-handling measures for smoother operations.

Key setup steps include:

- Defining metrics: Choose the financial metrics and data points you want to monitor.

- Setting frequency: Align scraping intervals with market activity, such as during trading hours.

- Error management: Implement checks to handle issues like missing data or connection errors.

InstantAPI.ai simplifies the process by managing JavaScript rendering and bypassing CAPTCHAs automatically.

Data Collection and Storage

Once your scraper is running, focus on organizing and securely storing the data for easy analysis.

Follow these database management tips:

- Use a PostgreSQL database with separate tables for key data types like market prices, volumes, financials, and economic indicators.

- Ensure security by encrypting data both at rest and in transit, enabling role-based access, and securely storing credentials.

- Sync your data using unique identifiers such as trading dates, security symbols, or transaction IDs to avoid duplication.

Keep a detailed record of your data sources, collection times, and any adjustments made. This helps maintain accuracy and makes your analysis more straightforward.

sbb-itb-f2fbbd7

Web Scraping Guidelines and Ethics

Legal and Ethical Rules

Scraping financial market data requires strict adherence to legal and ethical standards. This ensures data accuracy while respecting the rights of the websites being accessed. Financial institutions must navigate these rules carefully to avoid legal issues and maintain trust.

Here are some key legal considerations:

| Requirement | Description | Best Practice |

|---|---|---|

| Terms of Service | Rules for using a website's data | Always review and follow the site's terms of use |

| Data Access | Public vs. private information boundaries | Scrape only publicly available data |

| Server Load | Impact on website performance | Use rate limiting and scrape during low-traffic times |

| Data Rights | Copyright and ownership issues | Respect ownership and provide proper attribution |

The 2019 LinkedIn vs. hiQ Labs case clarified that scraping publicly accessible data is legal, as long as it doesn't harm the website or breach its terms of service.

"Businesses must assess whether scraping harms the source website."

To stay ethical, financial institutions should:

- Pay attention to robots.txt files for access permissions.

- Get proper authorization if required.

- Ensure data security is a priority.

- Steer clear of collecting personally identifiable information (PII).

- Keep detailed records of data sources for transparency.

Once legal and ethical compliance is in place, focus on technical practices to ensure data quality.

Performance and Accuracy Tips

After meeting compliance requirements, technical strategies are key to maintaining reliable and actionable financial data.

Here’s how to enhance performance and accuracy:

- Set automated checks for consistency: Regularly compare scraped data with historical patterns to catch anomalies.

- Monitor for website changes: Keep an eye on updates to website structures that might disrupt scraping.

- Optimize request patterns: Schedule scraping during low-traffic periods and use proxy rotation to spread the load.

A robust verification system can include:

| Verification Step | Frequency | Purpose |

|---|---|---|

| Manual Sampling | Daily | Spot-check scraped data against the source |

| Statistical Analysis | Hourly | Identify outliers and irregularities |

| Source Comparison | Real-time | Cross-check data from multiple sources |

| Error Rate Tracking | Weekly | Monitor trends in accuracy over time |

Using Scraped Data in Finance

Building Financial Models

Creating effective financial models involves turning structured, real-time data into actionable insights. Financial institutions often organize their data integration process into categories like these:

| Analysis Type | Data Sources | Application |

|---|---|---|

| Fundamental | Balance sheets, quarterly results | Evaluating company value and financial health |

| Technical | Historical price data, trading volumes | Identifying patterns and trends |

| Sentiment | Social media, news articles | Predicting market mood and reactions |

| Alternative | Web traffic, satellite imagery | Gaining insights from unconventional sources |

For example, in December 2022, analysts converted figures like "30.818B" into precise numerical values in billions to standardize market capitalization data.

These refined models are key to crafting targeted investment strategies, as shown below.

Investment Analysis Example

In August 2024, combining various data streams - such as stock prices (via Yahoo Finance API), social sentiment (from Twitter Analysis), and economic indicators (sourced from government databases) - provided a sharper analysis of Apple Inc.'s market position, leading to improved investment decisions.

| Data Component | Source | Impact |

|---|---|---|

| Stock Prices | Yahoo Finance API | Enabled real-time price tracking |

| Social Sentiment | Twitter Analysis | Predicted market reactions |

| Economic Indicators | Government databases | Analyzed broader economic trends |

For Apple Inc., blending stock price data with social sentiment analysis offered a more detailed understanding of market behavior and price fluctuations.

When implementing such strategies, consider these factors:

- Data Accuracy: Use automated checks to maintain high-quality data.

- Timeliness: Prioritize real-time data for quick decision-making.

- Correlation Analysis: Spot relationships between different data points.

- Risk Management: Diversify data sources to better evaluate risks.

Financial analysts have increasingly turned to alternative data sources, such as satellite images of retail parking lots or web traffic trends, to uncover insights that go beyond traditional metrics. This broader approach helps create well-rounded and precise investment strategies.

Conclusion: Enhancing Finance with Web Scraping

AI-driven web scraping has changed how financial data is collected, offering automation with accuracy rates exceeding 99.99%. This level of precision allows organizations to gather data efficiently and at scale.

The finance industry has already seen shifts in workflows thanks to these tools. For example, Scalista GmbH improved its analysis processes, showcasing the effectiveness of AI-powered scraping solutions.